Bitwise Asset Management has applied for a new Exchange Trade Fund (ETF) to ride the wave of corporate Bitcoin adoption.

The proposed ETF is called the “Bitcoin Standard Corporation ETF” and will invest in public companies that own Bitcoin at the Ministry of Finance. An ETF filing with the US Securities and Exchange Commission (SEC) outlines the criteria for eligible companies.

Keep at least 1,000 BTC. It has a market capitalization of at least $100 million. It has an average daily trading liquidity of at least $1 million. Less than 10% of stock is private.

Unlike other ETFs that increase the weight of a company by market size, this fund is weighted by holding Bitcoin. Bitwise also has a cap to ensure diversification. There is no single stock above 25% of ETFs.

For example, MicroStrategy, which holds over 444,000 BTC despite Tesla’s larger market capitalization, weighs more than ETF than Tesla. Tesla has 9,720 BTC, a small portion of MicroStrategy holdings.

“We feel that 2025 will be a huge year for new companies that are adopting Bitcoin standards,” said Hunter Horsley, CEO of Bitwise.

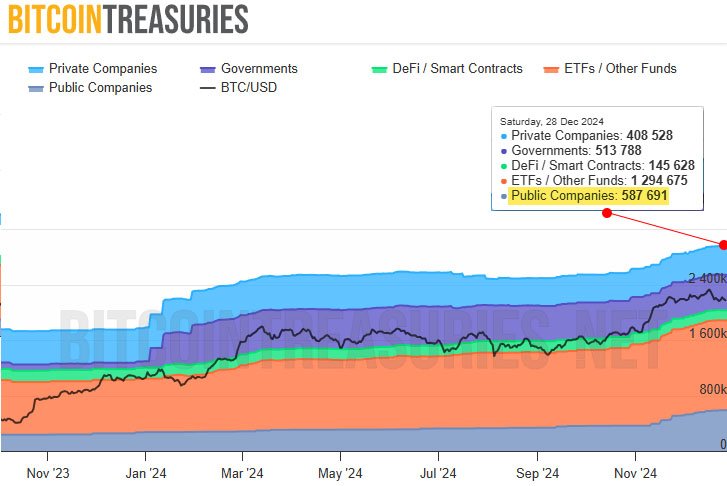

Bitcoin adoption by companies has grown rapidly in recent years, with publicly traded companies adding BTC to their finances. According to Bitcointreasuries, public companies currently own almost 20% of all Bitcoin held by entities around the world, with 587,691 BTC.

One notable example is Kulr Technology Group, which bought 217.18 BTC for $21 million and saw its share price rise by 40%. The other is Matador Technology, which plans to allocate $4.5 million to Bitcoin.

Companies are beginning to view Bitcoin as a financial asset. Bitcoin prices rose 117% this year to around $108,000, the highest ever in December. It has since been stable at $95,800. Many analysts believe that digital assets are still undervalued.

“The BTC Treasury operational virus is spreading,” said Nate Gelachi, president of ETF Store. He mentions an increase in companies outside the digital asset industry, which diversifies the Treasury with Bitcoin.

It’s not just Bitwise’s suggestions. Strive Asset Management, co-founded by Vivek Ramaswamy, has also applied for the Bitcoin Bond ETF. These are bonds issued by companies that are deeply involved in Bitcoin, and revenue is used to buy more BTC.

ETF Race highlights the growing desire among investors for innovative ways to gain exposure to Bitcoin and its associated financial products.

While corporate Bitcoin adoption and ETFs offer new opportunities, they are not without risk. Analysts warn of selling if demand dies, especially with Bitcoin volatility.

The current price of $95,800 is up 143% from this year’s low. If you have a big dip under this support it could trigger more sales.

Despite the risks, industry leaders are optimistic. With clarity of regulations, supportive administrations and political changes, they believe the setting is set for Bitcoin to continue to rise.