Ethereum dropped 22% despite Eric Trump’s endorsement and increasing whale activity.

Whale buying spiked as large investors positioned themselves in the face of a downtrend.

On the 4th of February 2025, Eric Trump made waves by endorsing Ethereum’s [ETH] on his X (formerly Twitter) account, urging followers to buy Ethereum.

However, since then, Ethereum’s price has dropped massively, by 22%. Despite this decline, a surge in whale activity has been recorded, with 110,000 ETH being accumulated in just 72 hours.

Amid mixed signals, one does wonder: Are large investors positioning themselves for a rebound, or is the market still on a downward trajectory?

Eric Trump’s endorsement and subsequent decline

Source: X

The initial reaction to Trump’s endorsement was followed by a brief price surge, but the rally quickly fizzled out. Since then, Ethereum’s price has dropped 22%, leading to questions about the lasting impact of his endorsement.

Source: X

Several factors have contributed to the price decline. A significant $1.5 billion hack of the Bybit exchange on the 25th of February undermined investor confidence, triggering a broader market selloff.

Additionally, fading euphoria following President Donald Trump’s election, coupled with unmet expectations for a pro-crypto regulatory framework, has dampened market sentiment.

Global economic uncertainties have also pressured Ethereum’s price downward.

Whale accumulation: A vote of confidence or a tactical play?

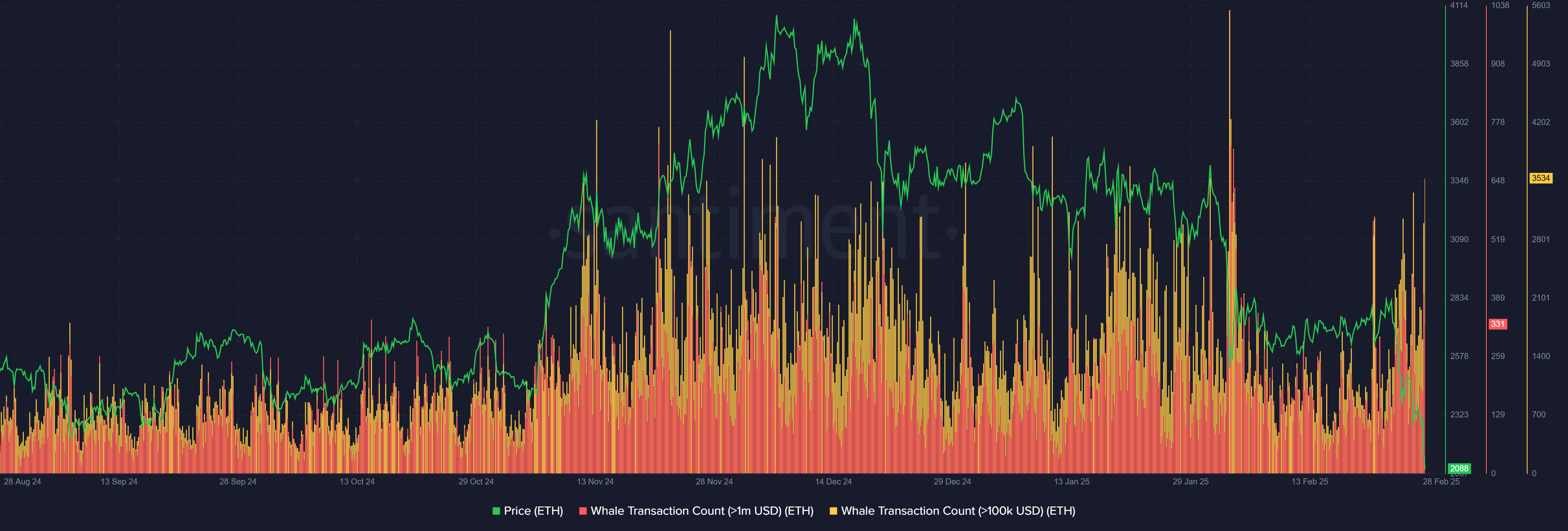

Despite Ethereum’s 22% drop, whale activity has surged, with 110,000 ETH accumulated in just 72 hours. Santiment data highlights a sharp increase in whale transactions.

This suggests large investors may be positioning themselves for a rebound or capitalizing on discounted prices.

Source: Santiment

Historically, similar accumulation phases have been followed by strong recoveries, but not always.

For instance, heavy whale activity in late December 2024 coincided with ETH’s peak, and mid-January saw a similar accumulation, which aligned with a brief bounce.

If ETH holds the $2,100–$2,135 range, this could reinforce bullish sentiment. However, a sustained break below this level could suggest that whales are securing liquidity before a deeper correction.

Ethereum: Whale confidence vs. bearish momentum

Ethereum’s oversold RSI at 38.90 and a deepening MACD bearish crossover indicate a prolonged downtrend. The 50-day SMA at $2,929 remains significantly above Ethereum’s current price of $2,109, reinforcing bearish pressure.

If whales are buying to front-run a recovery, reclaiming the $2,200–$2,300 range could validate a short-term bounce.

Source: TradingView

Retail investors should remain cautious. If ETH fails to hold key support, the next major demand zone lies around $1,900–$2,000.

Whale buying isn’t always a definitive bullish signal, especially in a market-wide downturn. Retail investors should watch for confirmation of a trend reversal before following whale sentiment.