This week, GRAYSCALE has also submitted Litecoin and Solana’s ETF submission documents on SEC, and has a rumor that suggests that regulatory authorities may deny the volatile lawsuit.

Arthur Hayes predicts the Bitcoin mini -financial crisis

Arthur Hayes, a former BitMex CEO, has modified his short -term bitcoin forecast. Earlier this month, he predicted that Bitcoin would peak in mid -March.

But Hayes has updated his prospects this week, stating that BTC is already in the crisis of this decline.

“I will reverses the order of my triple essay series. We are looking for a revision of $ 70,000 to $ 75,000 in BTC, a mini -financial crisis, and a resumption of money prints sent to $ 250,000 by the end of the year.” did.

Hayes’ short -term bear prospects for bitcoin were promoted due to the deterioration of the global illegal fluid environment. This is caused by the decrease in monetary printing in major economies in the United States, China, and Japan, tightening the US’s 10 -year financial rate, tightening the federal preparation system.

Hayes argued that bitcoin was particularly sensitive to changes in global fluid conditions and could lead to predicted slump. At the time of press, Bitcoin was trading for $ 104,709, which decreased by 0.3 % in the past 24 hours.

GrayScale is seeking a SEC approval of Solana and Litecoin ETF

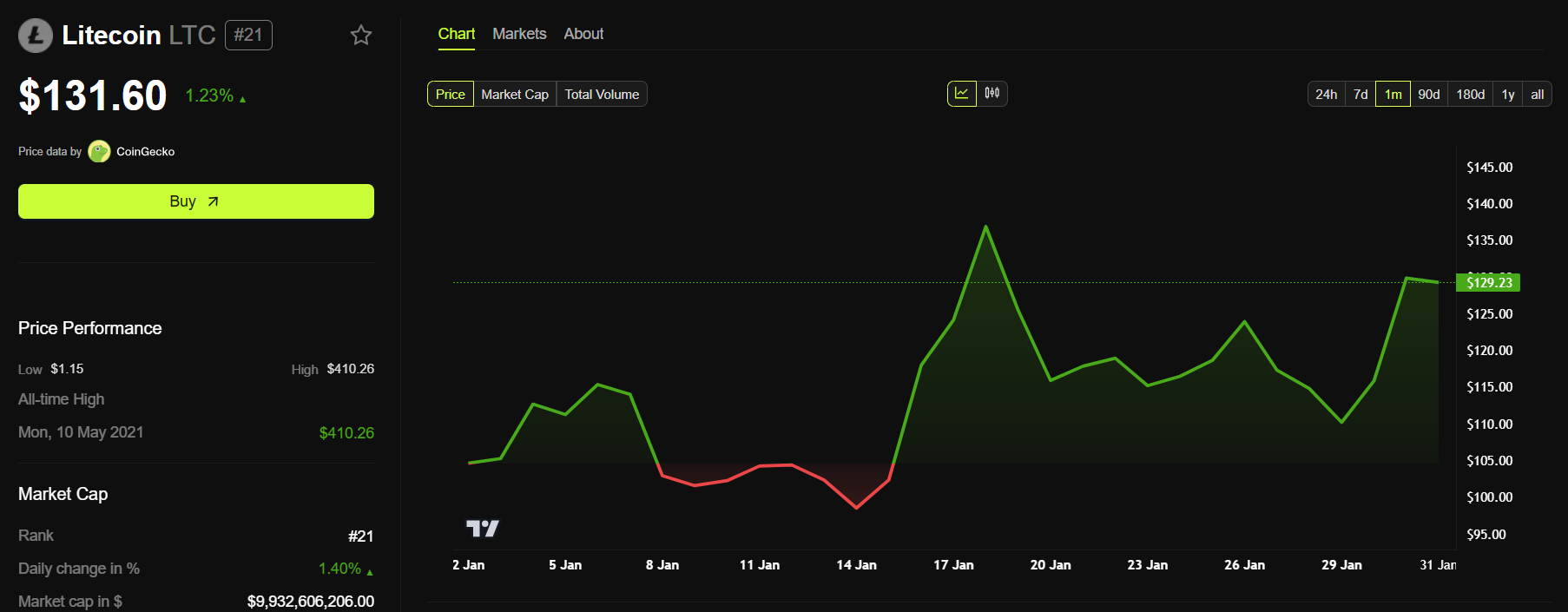

Grayscale, one of the largest encryption asset management companies, has submitted an application at the ETF SEC, which tracks both litecoin and Solana. The company’s Litecoin ETF marks only the second filing following the application of the Canary Capital in October.

Furthermore, according to ETF analyst Eric Barknas and James Sefat, Litecoin or Hedera ETF is more likely to obtain SEC approval earlier than Solana.

“It’s not all at once, but I’m expecting the waves of cryptocurrency ETF next year. At first, the BTC + ETH combo ETF is probably Litecoin (because it is a fork of BTC (so A) product). And HBAR (because it was not labeled), and XRP/Solana (labeled, securities in the litigation on hold) and Barknus.

It seems that their predictions have been realized because SEC has already approved the approval of Bitcoin and Ethereum ETF.

Nevertheless, the GRAYSCALE application did not have a major impact on the price of LiteCoin. At the time of press, LTC was traded for $ 131.60, which increased 1.2 % in the past 24 hours.

Zachxbt tracks $ 29 million SUI TOKEN EXPLOIT

Blockchain investigator Zachxbt has recently exposed a SUI token loss worth $ 29 million in December 2024. On January 26, ZachXBT has clarified the details of Exploit targeting the main owners of the SUI network.

According to what was reported, the attacker sucked up 6.27 million SUI tokens on December 12, which was rated $ 29 million. The stolen assets were moved from SUI to Ethereum using bridging tools, and then washed the trails of tornado cash through torado cash to make the trail unclear.

“The victim moved the .SUI domain to a new compromise immediately after theft. The current restrictions with the SUI block Explorer and the SUI analysis tools make it difficult to track theft,” said Zachxbt. I am.

ZachXBT made a headline in January after clarifying that the US government had helped to recover a significant part of $ 20 million stolen by hack.

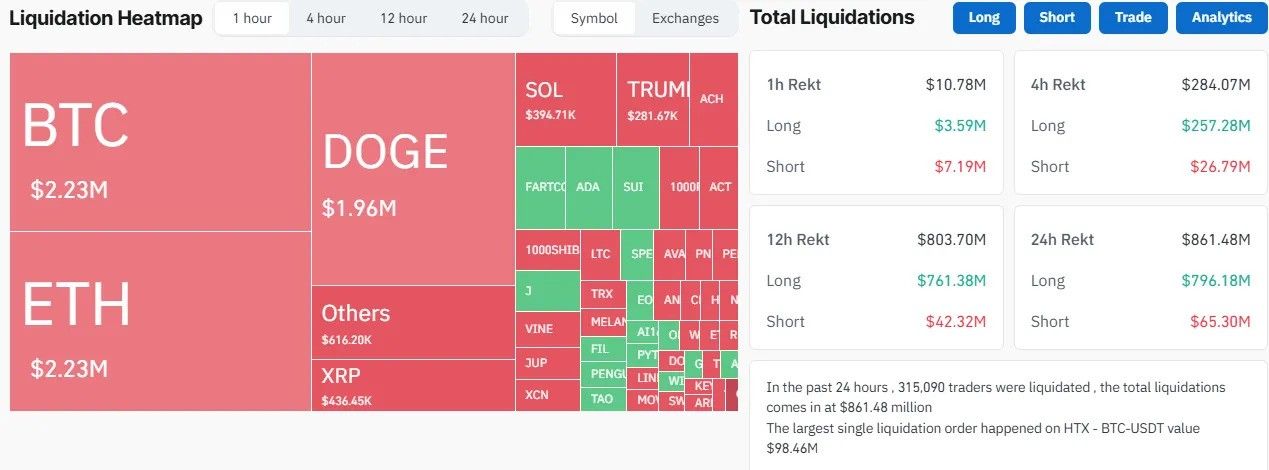

Deepseek causes the sale of major ciphers, and is liquidated in just one day

China’s AI Startup DeepSeek’s announcement is consistent with sudden sale in the cipher market.

Deepseek, which was founded two years ago, has established and stands out as an established AI giant competition, such as Openai, Meta, and NVIDIA. Development costs were less than $ 10 million, and DeepSeek has emerged as a destructive competition, causing discussions among experts on its long -term impact.

With the rise of Deepseek, bitcoin (BTC) decreases by more than 5 % in a few hours, and the main Altcoins have seen a sudden decline of 8-10 %. According to Coinglass data, 315,090 traders were liquidated on January 27 within 24 hours, and totaled over $ 800 million.

Some people believe that market crashes are due to the growing popularity of Deepseek and the potential effects on the stock market. Ash Crypto, an industry veteran, is one of the people who links volatility to a wider market response caused by the rapid rise of Deepseek.

“This has nothing to do with the encryption market and the US stock market,” he explained.

Ash Crypto has led to the re -evaluation of the over -evaluated high -tech stocks, and quoted Deepseek as one reason. The AI Crypto segment suffered in the aftermath of the rise of Deepseek, and the market capitalization of AI Crypto tokens decreased in two digits.

Is Ripple vs. sec exceeded?

SEC may have withdrawn the lawsuit against Ripple without the announcement. The committee has deleted the reference to the case from the website, but other encrypted litigation is still seen.

Social media users have noticed that the SEC website has deleted all references to this lawsuit.

“Is Ripple released from SEC? I searched for” Ripple “in the SEC litigation section, but there is no result! Is the court struggle just over? Is this the last chapter of Ripple vs SEC? If it was true, this could be a historic moment for XRP, “said influencer John Squire (previous Twitter).

Commenters are also paying attention to other suits for Kraken and Coinbase are still on the website.

However, one lawyer argued that the lawsuit is still active on Pacer, a government website that provides access to the federal court.

“SEC website is not important. This appeal is still open in the national pacar system. It has just been logged in. The last entry submits the outline of the ripple time extension. The case status is still active.

Disclaimer

Beincrypto is working on unbalanced transparent reports in compliance with Trust Project Guidelines. This news article aims to provide accurate and timely information. However, it is recommended that readers verify the facts independently and consult with experts before making a decision based on this content. Note that contract conditions, privacy policy, and exemptions have been updated.