Jupiter’s TOTAL VALUE LOCKED (TVL) exceeds Raydium and is placed as the second largest protocol in the Solana blockchain. This occurs after a series of positive developments on the past week of the decentralized exchange (DEX).

The Jup token has grown significantly and has emerged as the top market for the past 24 hours. It seems that the growth of DEX and the rapid increase in JUP have been ready to extend these profits.

Jupiter overtakes Solana’s Radium

Jupiter’s TVL has increased 5 % in the past week. According to Defillama, it is currently $ 2.87 billion, and TVL has secured its second largest protocol in Solana. With this rapid increase, Radium has been displaced and is now ranked third on a $ 2.7 billion TVL.

The rapid increase in TVL will follow a series of positive development announced by DEX at the Catstanbul 2025 event. In particular, Jupiter has announced the acquisition of Moonshot and SonarWatch’s shares to create Solana Portfolio Tracker. In addition, DEX is working on buying back JUP and assigning 50 % of the protocol fee for the planned burns of 3 billion tokens.

These announcements have increased their activities in DEX and have significantly increased TVL in the past few days.

Jup Bulls enhances value

Jupiter’s Jup TOKEN has actively reacted to these developments. Recently, demand has increased and its value has increased. Altcoin is traded for $ 1.19 at the time of press, and is paying attention to the rise of 24 % in the past 24 hours. During the review period, it exceeded the top 100 ciphers and became the market top gap.

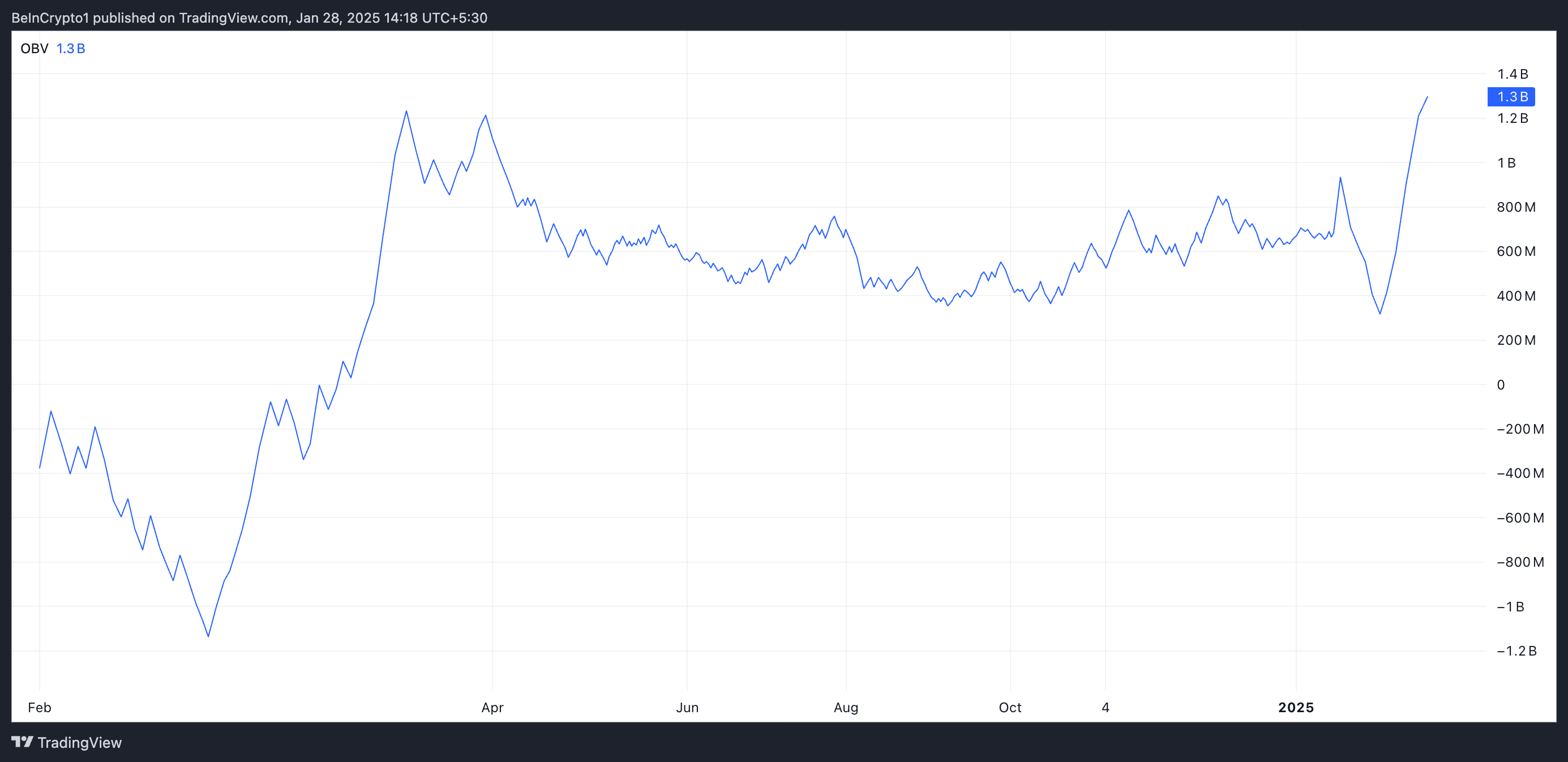

JUP/USD 1 -day chart evaluation reveals the possibility of an extension rally. At the time of the press, the balance volume (OBV) of the token is on the rise and is sitting at 1.3 billion in history.

The OBV of the asset measures the flow of money to enter and leave to predict price movements. This suggests to increase the pressure of buying when rising like this. This shows a potential bullish tendency, with a larger amount related to the upward price movement.

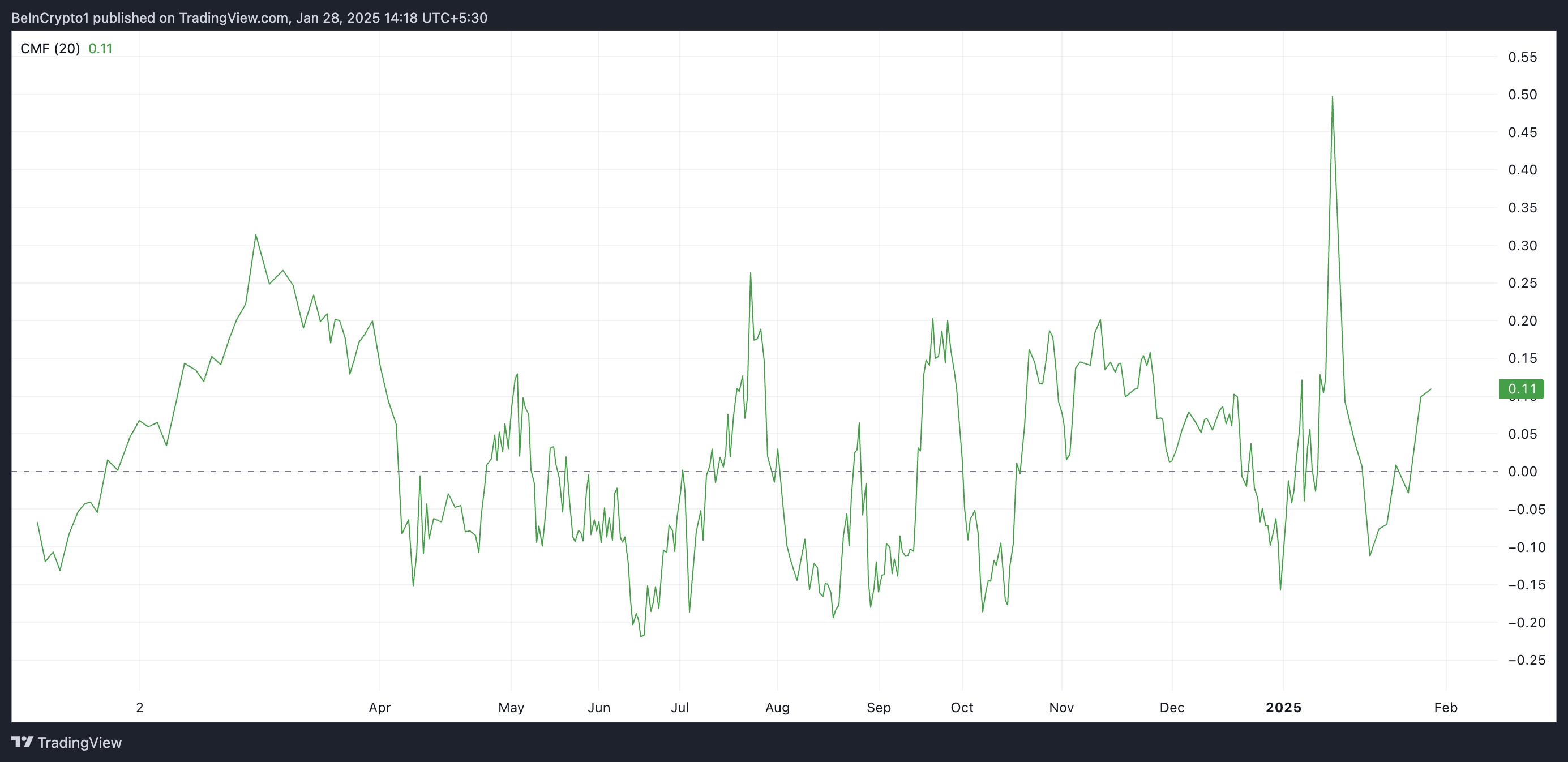

In addition, JUP’s Chaikin Money Flow (CMF) is located on the zero line at 0.11 at the time of this writing. This indicators also measure how to get in and out of assets.

If this indicator is positive, it indicates the purchase of pressure in the market and suggests that assets are accumulating.

JUP price forecast: The token stays between $ 1.46 and $ 1.08

At the time of press, JUP is traded for $ 1.19. If demand continues to increase, this may increase the value beyond 1.22 and $ 1.46.

Conversely, if the token witnesses the resurrection of the sale, this bullish outlook will be invalid. In that case, the price of JUP may be reduced to $ 1.08.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is intended for information only and should not be considered as a financial or investment advice. Beincrypto is working on accurate and fair reports, but the market situation may be changed without notice. Always carry out your own research and consult with an expert before making a financial decision. Note that contract conditions, privacy policy, and exemptions have been updated.