Litecoin (LTC) has formed a three -black crow crow lumbar leg pattern that is important on a daily chart, and has probably reversed the bearish after a recent bullish rally. This pattern is characterized by three consecutive bear candles with a minimum lower core, reflecting the strong sales momentum, and often functions as an earlier indicator of downside.

History data suggests that this formation is 65-70 %, especially if it is supported by additional technical signals, which is likely to lead to continuous bear price actions. One of these signals is a refusal from the $ 129 resistance zone that closely consistently consistently consistently consistent with the upper limit of the RTC re -accumulation range.

This zone is consistently functioning as a supply area and strengthening weakness. Currently, the LTC token is trading near the lower boundary of the reserved zone defined between $ 128 and $ 111. Failure below this range indicates a bullish momentum and increases the probability of a 100 -dollar support level re -testing.

Despite the $ 100 zone is an important focus for traders, cryptocurrency still trades the 50 -day moving average of $ 110.98, which works as an immediate support. However, the decisive breaks below this level and the daily closure may show a mid -term momentum shift by 50 days MA shifting to dynamic resistance.

When this scenario develops, the level of $ 100 is the main focus, given the historical importance of a strong accumulation zone. In addition, this level matches 100 days MA, further strengthening its reputation as an important safety net for deep decrease.

LTC’s on -fin data suggests a $ 100 re -test

The on -fin data has a profitability, aggressive addresses of whales/investor concentrated metrics, and a bearish prospect of Litecoin CryptoCurrency, which has an aggressive address that emphasizes that sales pressure and market trust are limited. We support further. These factors indicate the possibility of re -testing an important $ 100 support zone.

Profitable chartFor example, 87.03 % of the LTC address has now been found that there is no money and the profit is only 5.64 %. This imbalance reflects the seriously unreasonable loss, and may increase the pressure of selling as the token price falls.

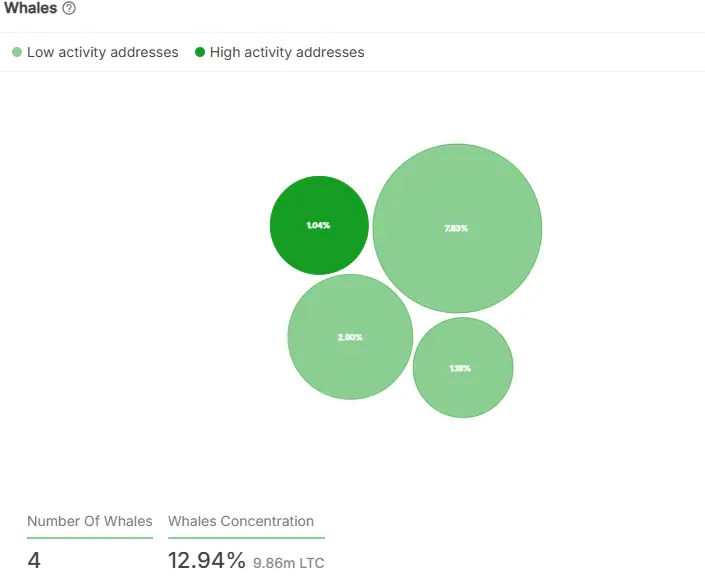

In addition, 7.33 % of the “money” addresses located between $ 103.60 and $ 115.69 remain vulnerable to surrender if cryptocurrency violates this low -border. Such a scenario accelerates the downward momentum toward $ 100. Whale activity data Further strengthen the bearish story. The four whales accounts for 12.94 % of Litecoin’s supply and are a total of 9.86 million LTC tokens.

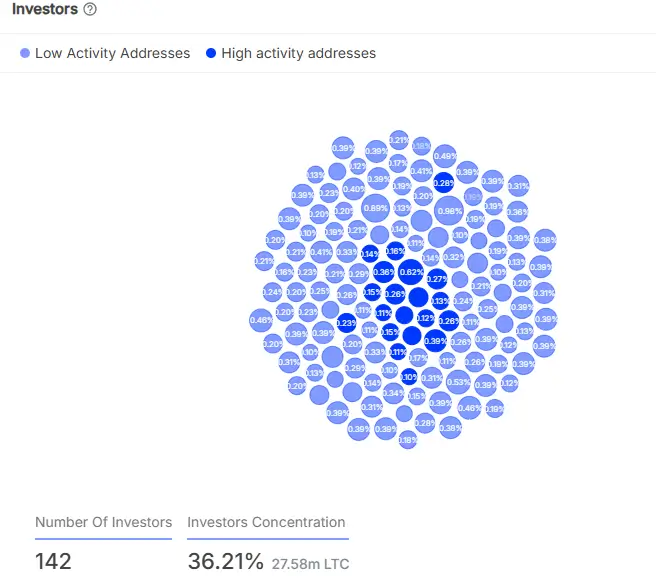

However, their limited activities at the current price level suggest that they hesitate to reflect the lack of confidence in short -term outlook. Without these major players, the market will be exposed to continuous defect pressure. Investor intensive data adds cautious emotions. The 142 major investor address holds 36.21 % (27.58 million LTC) of tokens, but the proportion is quite low activity address and emphasizes limited engagement.

The lack of this activity suggests that the investor is waiting for a low price before further accumulating, and the cryptocurrency may restore $ 100.

Read again: XRP exceeds $ 3 in whales and market optimism