TRON’s transaction count fell by 61% while whales and investors quietly accumulated more TRX

TRX’s price has been range-bound as social buzz rises and funding rates stay negative

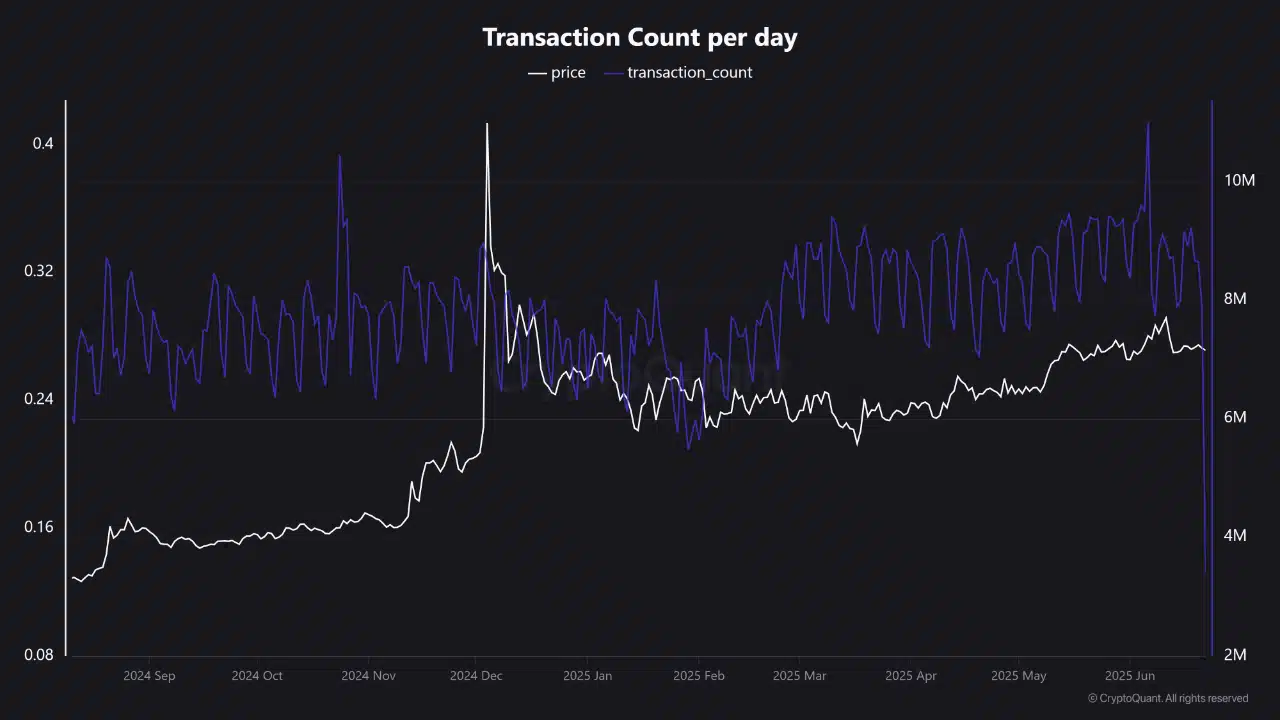

TRON’s network activity collapsed dramatically in June 2025, with daily transactions falling from 9 million to 3.5 million in just a few days. This steep decline erased nearly two-thirds of the network’s usage.

Despite this, TRX, at press time, was still trading at $0.2676 after a daily drop of just 1.9%. The nature of the decline—sharp and sustained—hinted at more than just reduced bot or farming traffic.

Instead, it seemed to allude to structural shifts such as bandwidth rule changes, app migrations, or user exodus to faster chains like Base or BSC. The silence isn’t random. In fact, it’s been coordinated, and it could reshape TRON’s long-term relevance.

Source: CryptoQuant

Are TRX whales and investors quietly positioning while retail stays passive?

TRON’s holder distribution has been undergoing a strategic realignment recently. Over the last 30 days, for instance, whale holdings increased by 9.36% and investor positions surged by 41.82%. On the contrary, retail participation climbed by just 3.79%.

This divergence could be a sign that large players are actively accumulating TRX, despite declining activity. Such behavior often precedes major directional moves, especially when the price remains relatively stable.

The growing concentration among smart money participants points to confidence in TRON’s recovery or future use cases. Therefore, retail’s lag may leave them vulnerable to late entries when volatility returns.

Source: IntoTheBlock

Can rising social chatter offset the silence on-chain?

TRX’s Social Dominance hasn’t been far behind either, climbing from below 0.3% to 1.37% within just days. This surge hinted at renewed community engagement and rising curiosity about TRON’s divergence between price and usage.

Often, heightened attention precedes momentum shifts. Especially when paired with whale accumulation.

While social hype alone cannot sustain price action, it can play a key role in driving short-term interest and speculative rallies.

As such, TRON’s growing visibility may attract new participants, even if on-chain fundamentals appear to weaken in the background.

Source: Santiment

Why do funding rates suggest caution despite price stability?

Although TRX has remained within a familiar price band, derivatives tell us a different story. Binance’s funding rate dipped to -0.022%, revealing that traders have been paying to hold short positions.

This persistent negative trend throughout June could be a sign that bears still expect downside.

While funding doesn’t always predict immediate moves, consistent negativity usually alludes to an undercurrent of bearish conviction.

Therefore, despite the spot price holding firm, leveraged players might be unconvinced of bullish continuation. This could suppress breakout potential, unless sentiment shifts rapidly.

Source: Santiment

Will TRX break out of consolidation or remain trapped below resistance?

TRX has continued to trade within a tight range, struggling to escape the $0.2422 to $0.2967 corridor. At the time of writing, it sat near the 0.382 Fibonacci level at $0.2631, just under the $0.2754-resistance.

Its price action seemed to have stalled after multiple failed attempts to clear overhead levels. However, strong support was present at $0.2422, guarding against a deeper breakdown. Unless momentum improves and volume returns, TRX may remain range-bound.

A decisive breakout above $0.2967 or a breach below $0.2422 will determine the next trend direction.

Source: TradingView

Will TRON’s price eventually reflect its fading utility?

The disconnect between TRON’s price and its plunging transaction count remains unresolved. While whales accumulate and social sentiment grows, the core network activity has cratered. This divergence cannot last indefinitely.

Either usage must recover to justify the current valuation, or the market will catch up to the chain’s declining fundamentals.