Trump has lost nearly $ 10 billion in the past two weeks, reflecting continuous sales pressure. Since technical indicators such as RSIs and CMF remain weak, Memcoin faces important tests and determines whether it can regain the amount of exercise or even take risks.

Trump RSI indicates that the seller is still controlling despite recent recovery.

Trump RSI is currently 31.68, lower than 50 marks for the past seven days, maintaining a remarkable low price of 19.8 on February 1. Meaningful recovery.

The sharp dip to 19.8 emphasizes extreme levels of weakness, but recent recovery to 31.68 has stabilized. But being unable to exceed 50 suggests that the bullish strength remains limited and keeps Trump in a vulnerable position.

The relative intensity index (RSI) is a vibration oscillator that measures the speed and size of the price of the price of 0 to 100.

More than 70 measured values indicate excessive conditions, indicates the possibility of correction, and suggests that the measured values of less than 30 may have assets and may be ready for rebound. 。

The 31.68 Trump RSI indicates that sales continue to sell, but indicates that sellers are continuing to dominate.

The lack of sustainable purchase pressure necessary to change the market emotions, so being unable to regain 50 over the past week will enhance the bearing prospects.

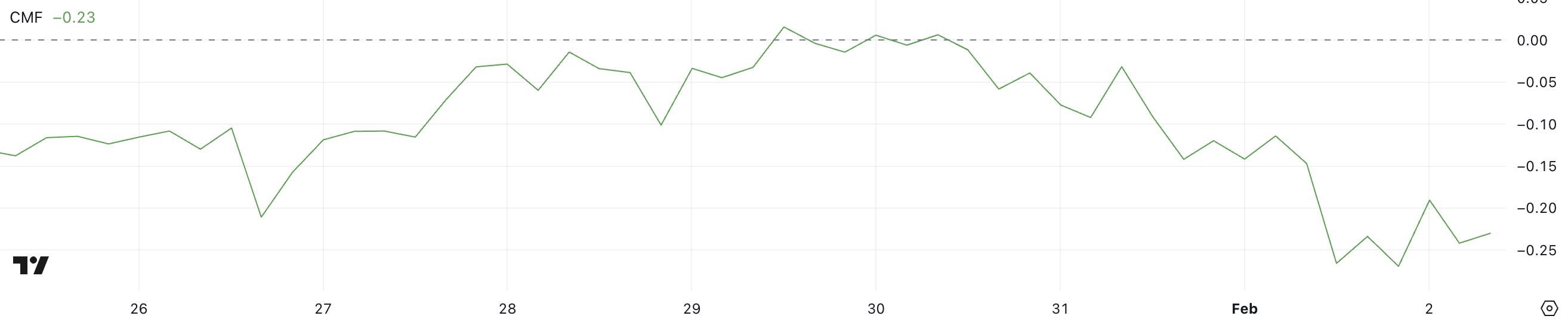

CMF is currently very low

Trump CMF is currently -0.23 and is marked for three consecutive days in negative areas. Yesterday, we reached the lowest value -0.27 in history, reflecting a considerable leakage of capital.

This sustainable negative reading suggests that the sales pressure exceeds the interest of shopping, and that more volume is trading at a lower price.

The slight recovery to -0.23 has shown some stabilization, but the overall tendency remains bearish, indicating that Trump is struggling to attract consistent fluid inflows.

Chaikin Money Flow (CMF) is an indicator of the accumulation and distribution of capital based on the specified period of price and amount. It indicates that in the range of -1 to 1, positive values indicate a negative value that suggests strong buying pressure and sustainable sales pressure.

-0.23 CMF reading means that the seller is controlling. CMF remains negative for three days, and given that it has recently reached the lowest level, this suggests weakness of demand and lack of sustainable purchase support, and in the short term. The price may be exposed to pressure.

Trump price forecast: Will the correction increase first?

Trump Meam Coin is currently trading near $ 21 and facing an important resistance of $ 24.58. One of the most imagined Memcoin, which has been released so far, may promote breakouts on this resistance.

If you buy pressure, if Trump regains bullish momentum, testing $ 24.58 will be more likely to be a scenario.

Successful breakouts beyond this level can be further upside down, and as traders take advantage of new enthusiasm, it may lead to a $ 30.47 test in the short term.

On the other hand, if the price of Trump fails to establish an up trend, and the seller is maintaining the control, the downward pressure may be enhanced. Lack of purchase intensity can lower the price, and $ 18.56 works as the next major support level.

If the weakness deepens and the volume likes the seller, Trump prices may be lower than this level, and the possibility of further negative aspects may be revealed.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is intended for information only and should not be considered as a financial or investment advice. Beincrypto is working on accurate and fair reports, but the market situation may be changed without notice. Always carry out your own research and consult with an expert before making a financial decision. Note that contract conditions, privacy policy, and exemptions have been updated.