The Bitcoin Market was a huge hit this weekend after Trump signed a presidential order in Canada, Mexico, and China. This movement sent a market to tail spins, which was less than $ 100,000, and wiped out billions of spaces.

On Saturday, Trump imposed a sudden tariff on major trade partners following his promise. His presidential ordinance has made 25 % tariffs on imports from Mexico and Canada and 10 % of China’s products. He quoted drug trafficking, especially Fentanyl.

“The sustainable inflow of illegal opioids and other drugs has a significant impact on our country,” Trump said in a presidential decree. These tariffs will stay in a predetermined position until Fentanyl takes serious action to stop entering the United States.

Customs duties are enforced at 12:01 am on Tuesdays, promoting prompt retaliation from the affected countries.

Mexico’s President Claudia Shainbaum has announced that her country will impose its own tariffs and non -tariff measures. Canadian Prime Minister Justin Trudeau has also announced 25 % of the US scope and warns further actions that could affect US energy sector.

The bitcoin market was not waiting. The BTC, which was slightly higher than $ 106,000, fell below $ 100,000 due to an investor panic in the trade war. ALTCOINS was hit more violently as major tokens dropped by 6-8 %.

After $ 500 billion in 24 hours, it was wiped out from the entire digital asset market. More than $ 700 million in the leverage dolls was liquidated, longing the longest hit.

The conventional market was closed on the weekend, and Bitcoin and other digital assets have first responded to Trump’s tariffs.

In the large drop of bitcoin, traders and analysts divide the following: Some people think that customs duties are ultimately good for bitcoin as hedges.

“You don’t know how surprising the sustainable tariff war is for Bitcoin in the long term,” said Jeff Park, director of Bitwise’s Alpha StrateGies. 。

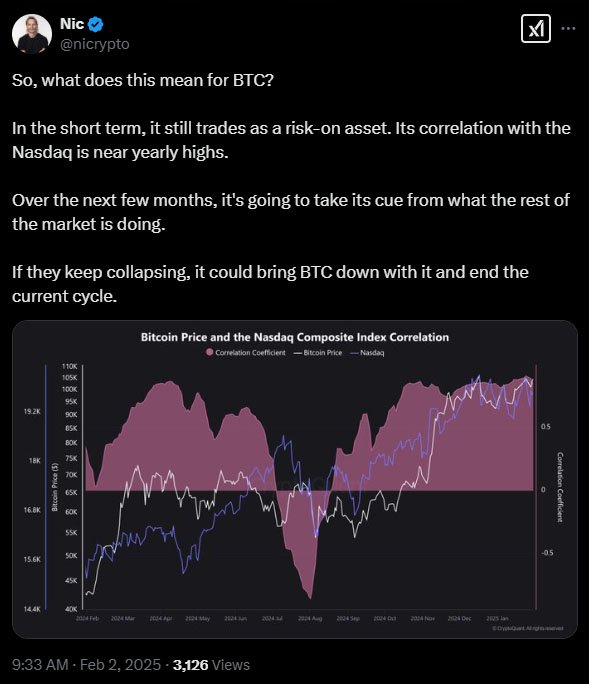

However, others believe that short -term effects can worsen. NIC PUCKRIN, COIN BUREAU’s CEO, stated that fluid shocks and large market risks could further defeat bitcoin in the short term.

“Bitcoin is still trading as a risk -on asset,” Paclin said. “If the market continues to collapse, BTC may be defeated and the current cycle may be terminated.”

Analysts are waiting to see what will happen next. Many believe that Bitcoin needs to hold more than $ 97,000 to maintain bullish. Analyst Ali Martinez says that $ 97,190 is the level to see. More than that, I was able to see $ 110k below, and a deeper correction was seen.

Despite the uncertainty, some celebrities are still bullish.

Robert Kiyosaki says that Bitcoin’s crash drops can bring good opportunities to buy.

Kiyosaki says that Bitcoin will be $ 175,000 to 350,000 by the end of 2025, and as the economy becomes more uncertain, it is looking at long -term value in digital assets.

Historically, Bitcoin is progressing steadily in February, especially in a few years after the Harving. Since 2013, Bitcoin has never been closed in red in February and has made 15 % profits on average.

However, tariff inflation can kill trends. Economists say that Trump tariffs increase US consumers and damage inflation from the Fed -Reduction -Reduction -Bitcoin.