H4 bullish order blocks failed, promised a new lowest price for virtual price prediction. OBV created a low -day price, and CMF showed a bearded rule.

Virtuals Protocol (Virtual) is heading down in the past three weeks. Pullback was considered to be healthy a week ago, but the loss at the 78.6 % Fibonacci retr’s level at 2.67 on January 19 was bearish.

Since then, the seller has worsened the beef disaster. Bitcoin (BTC) saw volatility expanded in the past three weeks.

The BTC pump did not raise the virtual, but the former loss dragged the virtual protocol and the remaining Altcoin market.

Virtual price prediction indicates a bearish turbulence.

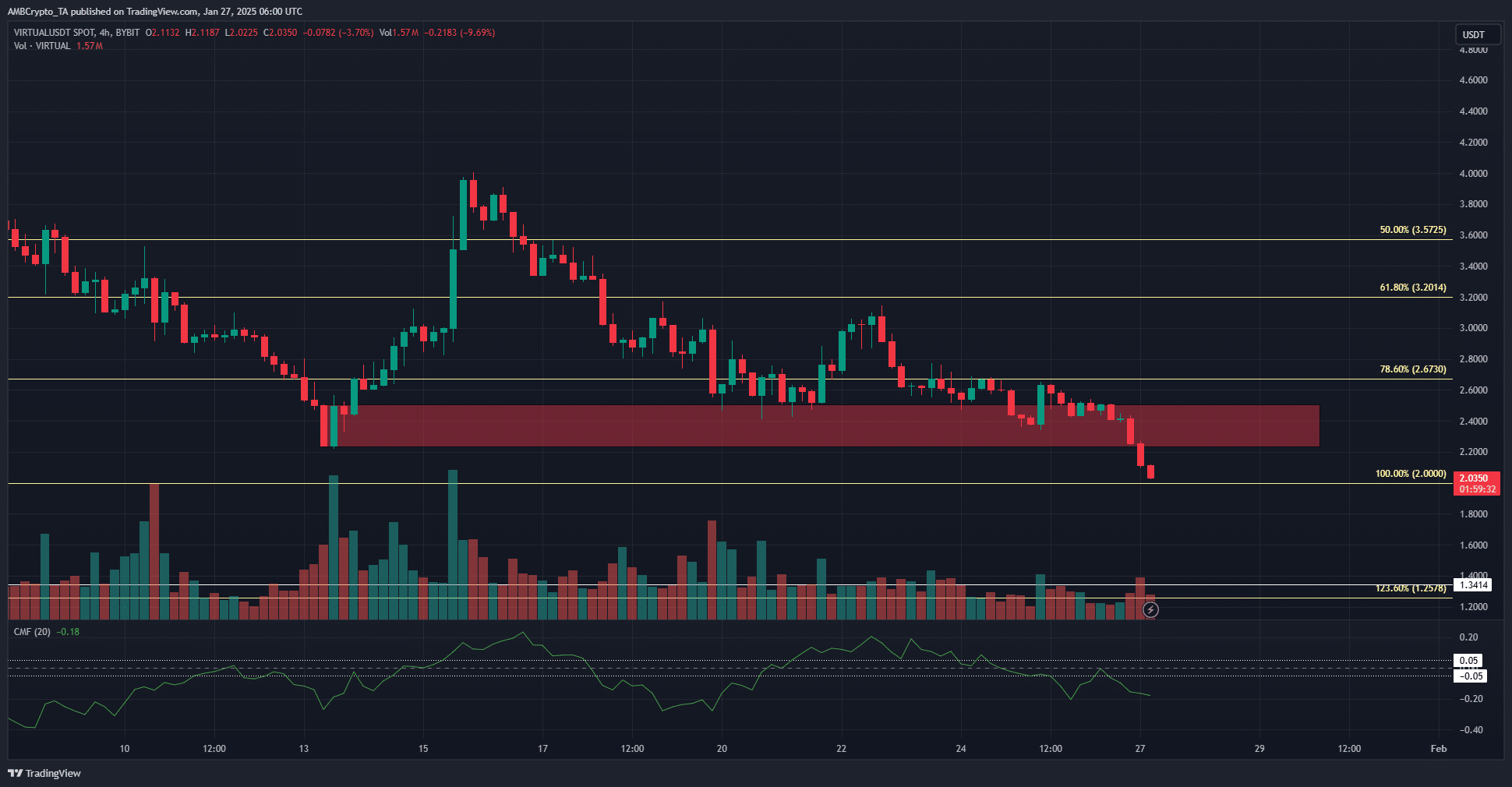

Source: TradingView Virtual/USDT

Fibonacci’s retracement level was plotted based on the token’s rising trends exhibited in December. At the time of press, the virtual was slightly higher than the 100 % retracement level.

The pullback turned into a downtrend in a daily time frame because it could not retain 78.6 % level.

The market structure was bearish, and earlier this month, the daily RSI jumped under neutral 50 to show that Bears would be dominant earlier this month. This has not been changed.

Even more worried was the steady loss of OBV. It creates a low low price throughout January and reflects a stable sales volume.

Source: TradingView Virtual/USDT

The H4 chart has enhanced the bearing outlook. The 2.4 bullish order block of $ 2.4 has been violated from mid -January. Currently, it is expected to function as a resistance zone.

Virtuals price forecast is a sustainable downtrend in the next few days.

The CMF was less than -0.05, and a bullish order block violated it means that $ 2 was immediately challenged. If you overcome it, a bear is very likely to raise the price to a $ 1.25 to 23.6 % south -facing extension.

This level matches horizontal support level and $ 1.34.

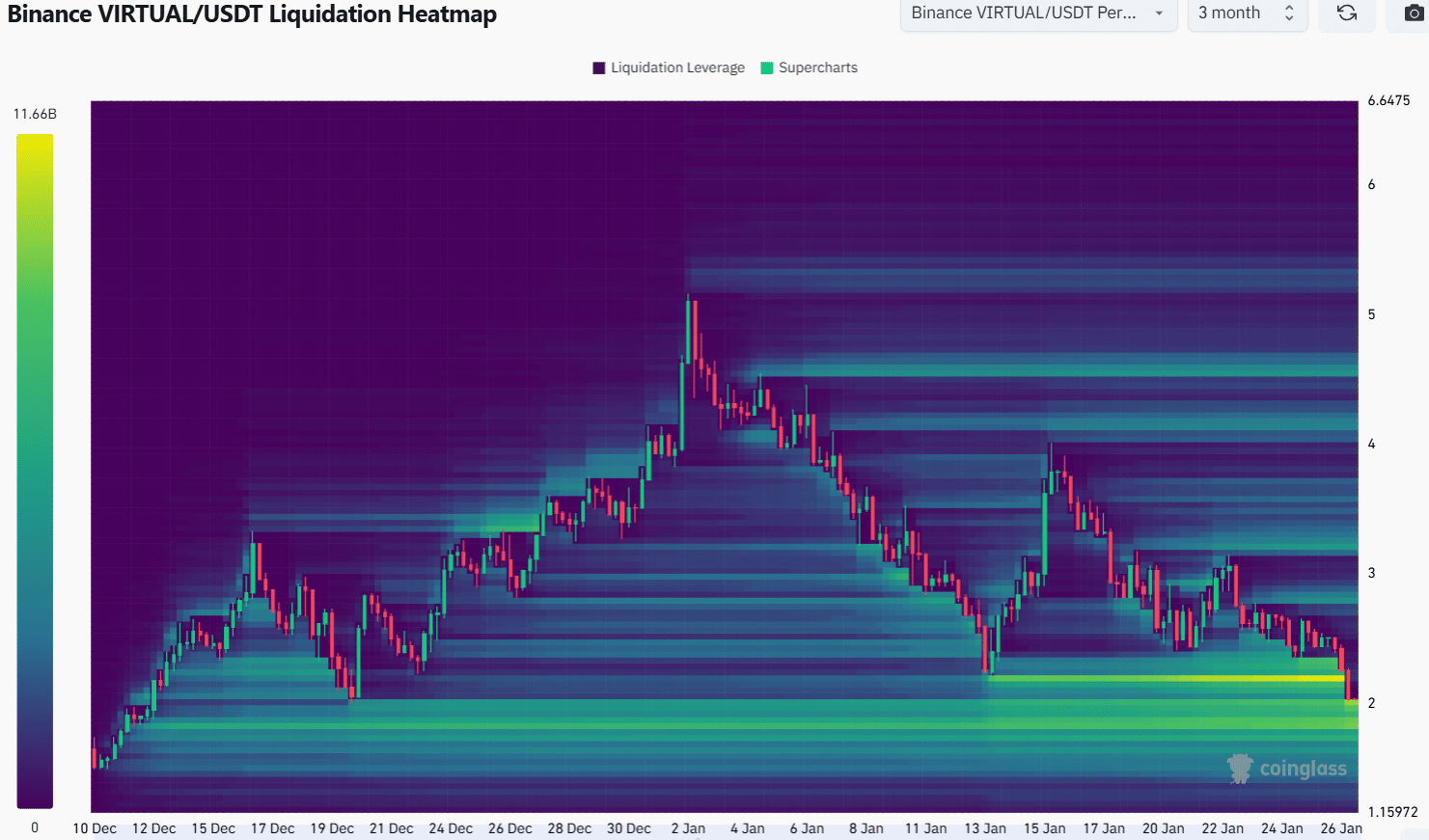

Source: Coinglass

The liquidation heat map indicated that the area of $ 2.2 and $ 1.95 to $ 1.85 was a bullish reversal. The past 24 -hour price action has shown that $ 2.2 has been sweeped, and the liquidation cascade has lowered the price.

Virtuals Protocol (virtual) Price forecast 2025-26

The bear pressure was unlikely to be tolerant in the next few days. This week, moving to $ 1.85 may begin. The possibility of bullish reversal may depend on capital inflows and BTC centements.

When BTC dropped below $ 100,000, virtual price prediction was strong and weak in the middle and mid -term.

Disclaimer: The provided information is not a financial, investment, transaction, or other kind of advice, but only the writer’s opinion.